Technical chart

Above is the monthly chart of mention stock, and we can clearly see that is has given strong and bigger rising channel breakout on monthly chart, stock is very well moving in higher high and lower high formation, with rsi its given bullish negative divergence, as price made higher high and ris was on lower top, and price able to break last top to confirm this divergence.

Technically very strong breakout with expected range till 910 as of now, further if bullish formation continued then it will look to move ahead to get till 1800-2400 levels too.

About company

Ahluwalia Contracts (India) Ltd. (ACIL) is a leading construction company in India with a rich history dating back to 1965. The company has completed some of the most challenging infrastructure projects in the country, including the Indira Gandhi International Airport, the Delhi Metro, and the Akshardham Temple.

ACIL is a public limited company with headquarters in New Delhi. It has a strong presence in the following sectors:

- Civil Engineering

- Building & Construction

- Power Projects

- Highways & Roads

- Water & Sewage Projects

- Industrial Projects

- Oil & Gas Projects

- Township Development

The company has a team of over 3,500 employees, including over 750 engineers. It also has a wide network of contractors and suppliers.

ACIL is committed to excellence in construction and has a strong focus on quality, safety, and environmental sustainability. The company is ISO 9001:2015 certified and has a Green Rating from the Indian Green Building Council.

In 2022, ACIL was ranked 4th among the top 50 construction companies in India by Engineering News-Record (ENR). The company was also awarded the “Best Construction Company” award by the Confederation of Indian Industry (CII) in 2021.

ACIL is a well-respected company with a strong track record of delivering high-quality projects. The company is well-positioned for continued growth in the years to come.

Here are some additional facts about ACIL:

- The company has completed over 1,000 projects in India and abroad.

- ACIL’s turnover in 2022 was over INR 2,000 crores.

- The company has a strong focus on social responsibility and has implemented several initiatives to improve the lives of the communities in which it operates.

Landmarks and Achievements

Ahluwalia Contracts (India) Ltd. (ACIL) has a long history of delivering landmark projects in India and abroad. Some of the company’s most notable achievements include:

- The construction of the Indira Gandhi International Airport in New Delhi, which was the first airport in India to be built on a public-private partnership basis.

- The construction of the Delhi Metro, which is one of the largest and busiest metro systems in the world.

- The construction of the Akshardham Temple in New Delhi, which is one of the most visited tourist destinations in India.

- The construction of the Chhatrapati Shivaji Maharaj Terminus in Mumbai, which is a UNESCO World Heritage Site.

- The construction of the Sardar Sarovar Dam in Gujarat, which is one of the largest dams in India.

ACIL has also been awarded numerous awards for its work, including:

- The “Best Construction Company” award by the Confederation of Indian Industry (CII) in 2021.

- The “Golden Peacock Award for CSR” by the World CSR Congress in 2020.

- The “National Safety Award” by the Ministry of Labour and Employment in 2019.

- The “CII-EXIM Bank Award for Excellence in Infrastructure” in 2018.

ACIL is a well-respected company with a strong track record of delivering high-quality projects. The company is well-positioned for continued growth in the years to come.

Here are some other landmarks and achievements of ACIL:

- The construction of the National Highway 8, which is one of the most important highways in India.

- The construction of the Eastern and Western Peripheral Expressways in Delhi, which are designed to reduce traffic congestion in the city.

- The construction of the Chhatrapati Shivaji Maharaj International Airport in Mumbai, which is the second busiest airport in India.

- The construction of the Dr. APJ Abdul Kalam Setu, which is the longest sea bridge in India.

- The construction of the National Thermal Power Corporation’s (NTPC) power plants in various parts of India.

ACIL is a major player in the Indian construction industry and has a significant impact on the economy. The company’s projects have helped to improve infrastructure, create jobs, and boost economic growth. ACIL is a responsible corporate citizen and is committed to social responsibility. The company has implemented several initiatives to improve the lives of the communities in which it operates.

Future Projects and Developments

Ahluwalia Contracts (India) Ltd. (ACIL) has a number of future projects and developments in the pipeline. These include:

- The construction of a new animal science university in Patna, Bihar. This project is worth INR 890 crores and is expected to be completed in 2025.

- The development of a new township in Gurugram, Haryana. This project is worth INR 1,500 crores and is expected to be completed in 2027.

- The construction of a new power plant in Madhya Pradesh. This project is worth INR 2,000 crores and is expected to be completed in 2028.

- The development of a new highway in Rajasthan. This project is worth INR 3,000 crores and is expected to be completed in 2029.

ACIL is also looking to expand its overseas operations. The company is currently bidding on several projects in the Middle East and Africa.

In addition to these specific projects, ACIL is also committed to investing in new technologies and innovations. The company is developing new ways to use sustainable materials and construction methods. ACIL is also investing in research and development to improve its safety and quality standards.

ACIL is well-positioned for continued growth in the years to come. The company has a strong track record, a talented team, and a clear vision for the future. I am confident that ACIL will continue to deliver high-quality projects and make a positive impact on the communities in which it operates.

Future road map

- Continue to focus on delivering high-quality projects. This is the foundation of ACIL’s success, and it will continue to be the company’s focus in the future. ACIL will continue to invest in its people and its processes to ensure that it can deliver high-quality projects on time and within budget.

- Expand into new markets. ACIL is already active in a number of countries, including India, the Middle East, and Africa. The company plans to expand into new markets in the future, such as Southeast Asia and Latin America.

- Invest in new technologies. The construction industry is rapidly changing, and ACIL is committed to staying ahead of the curve. The company is investing in new technologies, such as 3D printing and robotics, to improve its efficiency and productivity.

- Stay up-to-date on government policies. The government plays a major role in the construction industry, and ACIL is committed to staying up-to-date on government policies. The company will continue to lobby the government to create a favorable environment for the construction industry.

- Mitigate risks from natural disasters. Natural disasters are a risk for any construction company, and ACIL is committed to mitigating these risks. The company has a comprehensive risk management plan in place, and it is constantly reviewing its procedures to ensure that it is prepared for any eventuality.

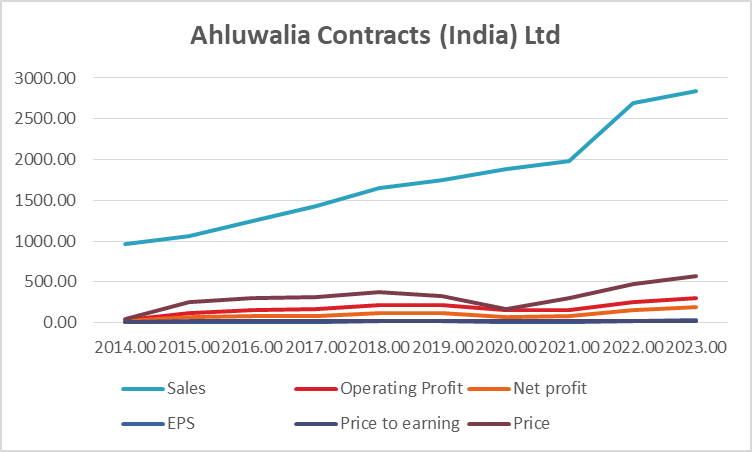

Fundamental data study on the basis of annual results

Market Cap ₹ 4,834 Cr.

Current Price ₹ 722

High / Low ₹ 745 / 394

Stock P/E 24.9

Book Value ₹ 183

ROCE 24.8 %

ROE 17.1 %

Face Value ₹ 2.00

Industry PE 32.1

Profit growth 24.6 %

Promoter holding 55.3 %

EPS ₹ 29.0

With the above data and graph analysis of fundamentals we can see that in past 10 years companies sales able to grow by almost 300%, operating profit able to grew by almost 12 times with the margin rate shifted from 3.7% to 10.70% and this lead to get strong net profits which also grew by 10 times in past 10 years.

very clean indication that stock is stable and growing from past 10 years, strong business volume with rising OPM will lead for strong EPS in coming days and thus it will surely affect its future growth.

Final Conclusion

Strong technical breakout, good company profile and strong data performance as per yearly result data, all these combination can produce good performance for sure and if that happen then stock will achieve its further levels till 900-1800-2400

one must keep watch on its ongoing construction projects, timely delivery and upcoming results.