Technical Chart study

Unveiling the Potential: Jumbo Bag Ltd’s Promising Investment Opportunity

Jumbo Bag Ltd, a pioneer in the packaging industry, is poised for a significant uptrend, as indicated by a thorough analysis of its monthly chart. The chart reveals compelling patterns and indicators that suggest a bullish trajectory for the stock in the coming years.

Firstly, a rising wedge breakout at the 36-37 range signals a potential upward movement. This breakout pattern typically indicates a continuation of the existing uptrend, highlighting the stock’s resilience and potential for further growth. Moreover, the breakout from this pattern suggests a renewed bullish sentiment among investors, paving the way for sustained upward momentum.

Furthermore, a closer examination of the Relative Strength Index (RSI) on the monthly chart reveals a bullish negative divergence. This occurs when the price of the stock forms a new higher high while the RSI simultaneously forms a lower low. Such a divergence often precedes a significant uptrend, indicating underlying strength in the stock’s price action. The subsequent confirmation by the price moving above the divergence level further solidifies the bullish outlook.

Taking into account these technical indicators, it becomes evident that Jumbo Bag Ltd is well-positioned for substantial growth in the foreseeable future. Investors can consider entering the stock at the current range of 36-42, with a strong support level or stop loss at 23. This provides a reasonable margin of safety while allowing room for potential upside.

As for the target price, a conservative estimate suggests a potential move towards the 70-100 range in the medium term. However, given the stock’s strong fundamentals and the bullish outlook indicated by the technical analysis, a target range extending up to 200 is also within the realm of possibility.

In summary, Jumbo Bag Ltd presents an attractive investment opportunity based on its compelling technical setup and promising outlook. With a breakout from the rising wedge pattern and a bullish divergence on the RSI, the stock is primed for significant upside potential in the coming years.

Entry: 36-42 range Stop Loss: 23 Target: 70-200 (conservative to aggressive)

Investors should conduct their own research and consider their risk tolerance before making any investment decisions.

About Company

Jumbo Bag Ltd stands as a prominent player in the packaging industry, recognized for its commitment to innovation, sustainability, and quality. Established with a vision to revolutionize the packaging landscape, the company has consistently delivered cutting-edge solutions that cater to diverse industries worldwide.

At the core of Jumbo Bag Ltd’s operations lies a relentless pursuit of excellence. The company’s extensive range of products encompasses flexible intermediate bulk containers (FIBCs), commonly known as jumbo bags, which are designed to meet the varied needs of customers across sectors such as agriculture, chemicals, food, construction, and more.

One of Jumbo Bag Ltd’s key strengths lies in its dedication to sustainability. In an era where environmental concerns loom large, the company has taken proactive steps to minimize its ecological footprint. By leveraging innovative materials and manufacturing processes, Jumbo Bag Ltd produces eco-friendly packaging solutions that prioritize recyclability and reduce waste. This commitment to sustainability not only aligns with global environmental initiatives but also resonates strongly with conscientious consumers and businesses seeking greener alternatives.

Furthermore, Jumbo Bag Ltd places a strong emphasis on quality assurance throughout its operations. Rigorous quality control measures are implemented at every stage of the production process to ensure that each product meets stringent standards of durability, strength, and safety. By upholding uncompromising quality benchmarks, the company has earned the trust and loyalty of customers worldwide, establishing itself as a reliable partner in the packaging industry.

In addition to its focus on sustainability and quality, Jumbo Bag Ltd distinguishes itself through its culture of innovation. The company continually invests in research and development to stay ahead of market trends and anticipate evolving customer needs. This proactive approach has enabled Jumbo Bag Ltd to introduce groundbreaking products and solutions that drive efficiency, enhance functionality, and deliver tangible value to clients.

Moreover, Jumbo Bag Ltd’s commitment to customer satisfaction is reflected in its comprehensive service offerings. The company takes a consultative approach, working closely with clients to understand their unique requirements and provide tailored solutions that address specific challenges. From custom designs to logistical support, Jumbo Bag Ltd offers end-to-end services that streamline the packaging process and optimize supply chain operations.

Beyond its operational excellence, Jumbo Bag Ltd places a strong emphasis on corporate social responsibility (CSR) initiatives. The company actively engages in community development projects, environmental conservation efforts, and charitable endeavors, demonstrating its commitment to making a positive impact beyond the realm of business.

In conclusion, Jumbo Bag Ltd stands as a beacon of innovation, sustainability, and quality in the packaging industry. With its unwavering dedication to excellence, commitment to sustainability, focus on innovation, and customer-centric approach, the company continues to set new benchmarks for success. As it charts a course towards a brighter, more sustainable future, Jumbo Bag Ltd remains poised to make enduring contributions to the global packaging landscape.

Fundamental Data Analysis

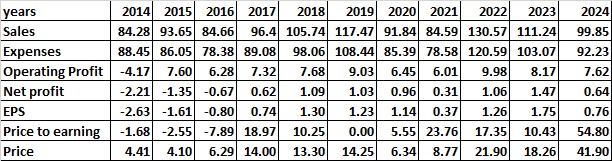

Let’s break down the provided data for Jumbo Bag Ltd and analyze its trends and factors for investment:

Sales Analysis:

- Sales have shown fluctuations over the years, with a noticeable increase from 2014 to 2019, followed by a decline in 2020.

- Despite the drop in 2020, sales rebounded significantly in 2022, recording the highest figure in the given period.

- Overall, there is a positive trend in sales, with a notable increase of approximately 55% from 2014 to 2024.

Expenses Analysis:

- Expenses have also fluctuated but generally followed the trend of sales.

- The increase in expenses from 2014 to 2019 aligns with the growth in sales during the same period.

- Despite the decline in sales in 2020, expenses decreased accordingly, indicating effective cost management.

- The overall trend in expenses shows an upward trajectory, with a growth rate slightly lower than that of sales.

Operating Profit Analysis:

- Operating profit reflects the company’s ability to generate profits from its core business activities.

- Despite fluctuations, there is an overall positive trend in operating profit, with a notable increase from 2014 to 2024.

- The increase in operating profit is in line with the growth in sales, indicating operational efficiency and effective cost control measures.

Net Profit and EPS Analysis:

- Net profit and earnings per share (EPS) have shown variability over the years.

- While there were losses in net profit and negative EPS in the early years, the company gradually turned profitable from 2017 onwards.

- The positive trend in net profit and EPS signifies improving profitability and financial performance.

Price and Price-to-Earnings (P/E) Ratio Analysis:

- The stock price and P/E ratio exhibit significant fluctuations over the years.

- Despite fluctuations, there is an overall upward trend in both price and P/E ratio, indicating investor confidence and growth prospects.

- The P/E ratio spiked in 2021, suggesting high investor expectations relative to earnings.

Turnaround Factors:

- The company’s ability to improve operating profit and turn losses into profits signals a successful turnaround.

- Effective cost management and operational efficiency contributed to the turnaround.

- Strong sales growth in 2022 further boosted profitability and investor confidence.

Strong Factors:

- Consistent sales growth over the years.

- Improving profitability and positive earnings trajectory.

- Effective cost management and operational efficiency.

Weak Factors:

- Fluctuations in expenses and profitability.

- High volatility in stock price and P/E ratio.

Based on the provided data, Jumbo Bag Ltd exhibits promising trends in sales, profitability, and earnings growth. The successful turnaround, coupled with improving financial performance, indicates the company’s resilience and potential for future growth. Despite fluctuations in expenses and stock price, the overall positive trajectory suggests a favorable outlook for investors. However, investors should carefully consider the volatility and conduct further analysis before making investment decisions. Overall, considering the company’s strong factors and turnaround success, investing in Jumbo Bag Ltd could be a viable option for long-term investors seeking growth opportunities.

Combined Technical and Fundamental view

Based on the combination of technical analysis and fundamental data, the conclusion to invest in Jumbo Bag Ltd can be drawn as follows:

Technical Analysis:

- Rising Wedge Breakout: The stock has recently experienced a breakout from a rising wedge pattern, suggesting a potential continuation of the upward trend.

- Bullish Divergence: A bullish negative divergence on the monthly chart, coupled with subsequent confirmation by price movement, indicates underlying strength and potential for sustained growth.

- Price Momentum: Despite fluctuations, the stock price has exhibited an overall upward trajectory, with periodic consolidations followed by upward moves.

Fundamental Data:

- Sales Growth: Jumbo Bag Ltd has demonstrated consistent sales growth over the years, indicating a strong demand for its products.

- Improving Profitability: The company has managed to improve its operating profit and turn losses into profits, reflecting effective cost management and operational efficiency.

- Positive Earnings Trajectory: Net profit and earnings per share have shown an improving trend, suggesting enhanced profitability and shareholder value.

Conclusion:

Considering both technical analysis and fundamental data, Jumbo Bag Ltd appears to be an attractive investment opportunity. The recent breakout from a bullish pattern and bullish divergence signal a potential uptrend, supported by the company’s strong sales growth and improving profitability. While there may be fluctuations in stock price and volatility in the short term, the overall trend suggests favorable prospects for long-term investors.

It’s important to note that all investment decisions should be made after thorough analysis and consideration of individual risk tolerance and investment goals. Additionally, staying updated on company developments and market trends is essential for informed decision-making. Overall, based on the combined insights from technical analysis and fundamental data, investing in Jumbo Bag Ltd could present a compelling opportunity for investors seeking growth potential in the packaging industry.