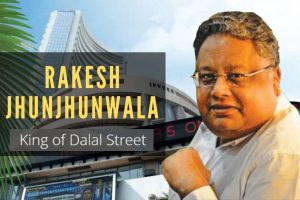

India’s Ace Investor with his Midas touch, Rakesh Jhunjhunwala, turned 60 on July 5. This year also marks his 35th year on Dalal Street.

Titan, the Tata Group-owned Firm has been a major money-maker for India’s biggest individual investor – Rakesh Jhunjhunwala. An early investor of Titan, Rakesh Jhunjhunwala has reaped gains from the company for over 19 years.

When the nation was under lockdown, wrestling with the effect of the Covid-19 pandemic on the economy, organizations, and monetary markets, the fortunes of Rakesh Jhunjhunwala kept on taking off. So far in the current money related to the year 2020-21 (Financial Year 2021), the total assets of Rakesh Jhunjhunwala and family have expanded Rs 2,514 crore with the estimation of their speculations by and by flooding past the Rs 10,000 crore mark. In light of Monday’s end, Jhunjhunwala family’s absolute interests in recorded organizations remained at Rs 10,797 crore, up 30 percent from the Rs 8,284 crore at March-end.

Mahindra Group, Chairman, Anand Mahindra Invests $1 Million in Indian Social Network Start-up Hapramp

On July 3, Bilcare Ltd stock hit its 52-week high of Rs 61.45 esteeming the stake of Jhunjhunwala couple at Rs 12.27 crore meaning the all-out profit was Rs 9.43 crore in 69 trading sessions.

During April – June 2020 quarter (Q1FY21), Jhunjhunwala expanded its stake in Rallis India, Jubilant Life Sciences, Federal Bank, NCC, and Firstsource Solutions (FSL), while cutting his holding in Lupin and Agro Tech Foods, the most recent shareholding design accessible on the trades show. Jhunjhunwala included Indian Hotels in his portfolio, procured 12.5 million shares of 1.05 percent stake in June quarter, against nil holding in the past quarter.

Regardless of the coronavirus hitting the economy, organizations, and budgetary markets, fortunes of pro financial specialist Rakesh Jhunjhunwala kept on taking off. In the current monetary year 2020-21 (FY21) up until this point, the total assets of Rakesh Jhunjhunwala and family have expanded Rs 2,514 crore. The estimation of their ventures has flooded past the Rs 10,000 crore mark once more. In view of Monday’s end, Jhunjhunwala family’s all-out interests in recorded organizations remained at Rs 10,797 crore, up 30 percent from Rs 8,284 crore in March quarter-end.

Among all the speculations, one specific stock helped the wizard of Dalal street Rakesh Jhunjhunwala win a little over Rs 13 lakh consistently for 69 trading sessions was Bilcare Limited. Jhunjunwala made Rs 9.43 crore in more than a quarter of a year from a load of Bilcare Ltd from March 23 this year. The Big Bull and his significant other held 19.97 lakh partake in the supply of pharmaceutical bundling research arrangements organization for the quarter finished March 2020.

Rakesh Jhunjhunwala buys 25 lakh DHFL shares – so is it a right time to buy for retail investors ?? see what technical says

While Jhunjhunwala claims 17.35 lakh shares, his better half Rekha Jhunjhunwala holds 2.62 lakh shares during the period. When Sensex and Nifty logged their greatest single-day misfortunes in their history on March 23, the portion of Bilcare Ltd tumbled to Rs 14.25 on the Bombay Stock Exchange and the estimation of Jhunjhunwalas’ stake in that session remained at Rs 2.84 crore.

In any case, on July 3, the stock hit its 52-week high of Rs 61.45 esteeming the stake of Jhunjhunwala couple at Rs 12.27 crore meaning the absolute benefit was Rs 9.43 crore in 69 exchanging meetings given the way that they kept their stake unaltered in the firm in Q4 of last monetary and initial three exchanging days of the current quarter of Financial Year 2020-21.

To date, Bilcare Ltd’s share cost has increased 126% over the most recent one year and risen 142% since the start of 2020. Bilcare Ltd stock on Wednesday was exchanging 1.91% higher at Rs 47.90. The organization yesterday submitted to Bombay Stock Exchange the Shareholding Pattern for the period finished June 30, 2020.

His stake in Tata Group-claimed watch and adornments producer – Titan Company – and tractor-creator Escorts stayed unaltered alongside 11 different organizations that incorporate Orient Cement, Multi Commodity Stock Exchange of India, ION Exchange, Crisil and Fortis Healthcare. Rakesh Jhunjhunwala and spouse Rekha Jhunjhunwala held more than 1 percent stake in 29 recorded organizations toward the finish of the March 2020 quarter.

Announced Standalone quarterly earnings figures for Bilcare are:

Net Sales at Rs 53.43 crore in March 2020 dipped 8.21% from Rs. 58.21 crore in March 2019.

Quarterly Net Profit at Rs. 83.39 crores in March 2020 surged 343.69% from Rs. 34.22 crore in March 2019.

EBITDA remains at Rs. 11.03 crore in March 2020 zooms 236.28% from Rs. 3.28 crore in March 2019.

Bilcare EPS has expanded to Rs. 35.42 in March 2020 from Rs. 14.53 in March 2019.

India’s Warren Buffet, Radhakishan Damani Biggest Bet of 2020 on this Chennai Based Cement Manufacturer in India

Among the part, Rallis India, Escorts, Jubilant Life Sciences, and Lupin helped Jhunjhunwala’s portfolio beat showcase returns at the file level since April 2020. These stocks on the whole included half, or Rs 1,246 crore, of the absolute Rs 2,514 crore gain in Rakesh Jhunjhunwala’s portfolio during the period under survey. Titan, in any case, failed to meet expectations of the market by increasing 7 percent. In the examination, the S&P BSE Sensex was up 26.7 percent during a similar period.

Given the sharp spat the business sectors since their March 2020 lows, most smart investors are currently careful and propose the direction will rely upon the quantity of Covid-19 cases and the advancement of the immunization to fight the pandemic. All things considered, value as a benefit class, they accept, ought to convey great come back from a drawn-out skyline.

“Given the critical convention as of now, we accept the worldwide value market may stay uninvolved throughout the following hardly any months as benefit booking may set in. Inside values, Indian values could fail to meet expectations their Asian companions in the following hardly any months given the absence of an interesting upgrade,” composed Jitendra Gohil, head of India value research at Credit Suisse Wealth Management India in a July 16 note co-created with Premal Kamdar, their value research examiner. They stay bullish on agri-connected, telecom companies, Fast Moving Consumer Goods, and utility segments.

Jhunjhunwala’s shareholding in GMR Infrastructure stayed unaltered at 1.41 percent, or 8.5 crore shares, in the June quarter. The tycoon financial specialist added numerous such stocks to his portfolio in June quarter Autoline Industries, Dishman Carbogen Amcis and Indian Hotels made it to Big Bull’s portfolio

“Markets are to a great extent concentrating on the income and the ongoing declarations from the file majors have decidedly amazed, which thus is powering the recuperation. Additionally, the worldwide markets are likewise not giving any indications of easing back down, helping the file to keep up the force. In any case, the rising Covid-19 cases and discusses network transmission could mark the pace ahead. We recommend concentrating more on hazard the executives and selecting quality counters for speculation,” he says.

It merits referencing that during the quarter finished June 30, 2020 quarter, Jhunjhunwala expanded his stake in Rallis India, Jubilant Life Sciences, Federal Bank, NCC, and Firstsource Solutions (FSL), while cutting his holding in Lupin and Agro Tech Foods, the most recent shareholding design accessible on the trades show. Jhunjhunwala included Indian Hotels in his portfolio, obtained 12.5 million shares of 1.05 percent stake in June quarter, against nil holding in the past quarter.

As of late, Jhunjhunwala and his better half Rekha procured 3.18 percent value in Dishman Carbogen Amcis during the quarter-finished June. Both purchased a 1.59 percent stake meaning 25 lakh shares each in the organization. The Big Bull additionally brought his stake up in Edelweiss Financial Services to 1.19 percent in the June quarter from 1.04 percent in the March quarter.