Introduction

The global shift towards clean and sustainable energy sources has prompted nations to reimagine their energy landscapes. In India, the quest for a cleaner and greener future has gained momentum, with a focus on reducing carbon emissions and increasing the share of renewable energy in the energy mix. NLC India Ltd, a leading energy company, has emerged as a pivotal player in driving this clean energy revolution within the country.

NLC India Ltd’s Commitment to Clean Energy: NLC India Ltd has strategically aligned its operations and investments with the vision of a cleaner and sustainable future. The company’s commitment to reducing its carbon footprint is evident through its initiatives aimed at transitioning away from fossil fuels. It has significantly expanded its portfolio to include renewable energy sources such as solar, wind, and hydroelectric power, showcasing its dedication to green energy.

Renewable Energy Projects:

- Solar Power: NLC India Ltd has established a substantial presence in solar power generation. The company has developed large-scale solar projects across various regions of the country. These solar installations not only contribute to India’s renewable energy capacity but also aid in reducing greenhouse gas emissions.

- Wind Energy: Harnessing the power of wind, NLC India Ltd has invested in wind energy projects that have added a considerable amount of clean power to the national grid. By leveraging the abundant wind resources available in different states, the company has played a pivotal role in diversifying India’s energy sources.

- Hydroelectric Power: NLC India Ltd’s involvement in hydroelectric power projects highlights its commitment to sustainable energy generation. Hydroelectric power is a reliable and renewable source that complements intermittent sources like solar and wind, ensuring a stable and consistent power supply.

Innovative Technologies and Partnerships: NLC India Ltd has not only embraced established renewable technologies but has also been at the forefront of exploring innovative solutions. The company’s collaborations with research institutions and technology partners have led to advancements in energy storage, grid management, and energy efficiency. These endeavors have not only enhanced the integration of renewable energy into the grid but have also facilitated the establishment of a robust and reliable clean energy infrastructure.

Economic and Environmental Impact: The transition to clean energy has not only environmental benefits but also economic advantages. NLC India Ltd’s initiatives have created job opportunities, stimulated local economies, and contributed to India’s energy security. Moreover, by reducing the reliance on fossil fuels, the company has helped mitigate air pollution and its associated health hazards, resulting in improved public health and quality of life.

Challenges and Future Outlook: While NLC India Ltd’s efforts are commendable, challenges such as intermittency of renewable sources, grid integration, and policy support remain. However, the company’s proactive approach to addressing these challenges through technological innovation, research, and collaboration positions it favorably to continue driving India’s clean energy revolution.

Technical chart study

Analyzing the technical monthly chart of NLC India, we can observe that the stock is currently tracing an expanding pattern. Notably, it has recently managed to test the upper resistance level. A potential breakthrough above this range holds the promise of enhanced performance in the future.

In accordance with the pattern, the stock has already signaled a breakout at 125, and the next significant breakout is anticipated above the 140 mark. Should this materialize, the pattern suggests a potential upward trajectory with target levels projecting around 225, 280, and even 350 in the upcoming years.

This technical analysis underscores the stock’s evolving dynamics and its potential for substantial growth. However, it’s important to consider that market movements are subject to various factors, and prudent risk management strategies are advisable when making investment decisions.

Future Developments and Plans

- Investment in renewable energy: NLCIL plans to invest Rs. 24,000 crore in renewable energy projects by 2030. The company has already set up a 300 MW solar power plant in Rajasthan and is planning to install another 50 MW solar plant in mine-reclaimed land at Neyveli. NLCIL is also looking to develop wind and hydro power projects.

- Development of a supercritical lignite-based thermal power plant: NLCIL is planning to develop a 1,320 MW supercritical lignite-based thermal power plant at Neyveli. This will be the first supercritical lignite-based power plant in India.

- Entry into the green hydrogen market: NLCIL is planning to enter the green hydrogen market. The company has already signed a memorandum of understanding (MoU) with Bharat Heavy Electricals Limited (BHEL) to study the feasibility of setting up a pilot plant for green hydrogen production.

- Expansion of mining operations: NLCIL plans to expand its mining operations in Neyveli and Talabira. The company is also looking to explore new lignite deposits in India.

- Development of new technologies: NLCIL is investing in research and development to develop new technologies for the mining and power generation sectors. The company is also looking to collaborate with international partners to bring in new technologies.

These are just some of the future developments and plans of NLC India Limited. The company is committed to growth and innovation, and it is well-positioned to play a leading role in the Indian energy sector in the years to come.

General trends and directions that NLC India Ltd

- Renewable Energy Expansion: Given the global focus on renewable energy, NLC India is likely to continue expanding its renewable energy portfolio. This could involve the development of new solar, wind, and hydroelectric projects, as well as exploring emerging technologies like energy storage and offshore wind.

- Clean Coal Technologies: As a coal-based energy company, NLC India might be investing in clean coal technologies to reduce its carbon emissions and environmental impact. This could include adopting advanced combustion techniques, carbon capture and storage (CCS), and efficiency improvements.

- Electric Vehicle Charging Infrastructure: With the growing adoption of electric vehicles (EVs), NLC India could explore opportunities in EV charging infrastructure. This aligns with the broader trend of integrating energy generation, storage, and transportation systems.

- Energy Efficiency Initiatives: NLC India might implement energy efficiency programs within its operations to optimize energy use and reduce costs. This could involve upgrading equipment, implementing smart grid technologies, and adopting energy-efficient practices.

- Diversification and Partnerships: The company may explore partnerships or joint ventures with other firms to diversify its energy portfolio further. Collaborations with technology companies, research institutions, and startups could lead to innovative solutions and new business opportunities.

- Government Initiatives and Policies: NLC India’s future plans could also be influenced by government policies and initiatives related to energy, environment, and sustainability. Adapting to changing regulations and aligning with national goals will likely be a priority.

- Community and Social Initiatives: Corporate social responsibility (CSR) initiatives could include community development projects, supporting local infrastructure, and contributing to sustainable development in the regions where NLC India operates.

- Digital Transformation: Like many industries, the energy sector is undergoing a digital transformation. NLC India might invest in digital technologies to optimize its operations, improve maintenance processes, and enhance overall efficiency.

- Focus on ESG (Environmental, Social, and Governance) Factors: NLC India could strengthen its commitment to ESG principles, which are increasingly important to investors and stakeholders. This might involve enhancing environmental practices, ensuring employee well-being, and maintaining transparent governance.

Remember, these are speculative trends based on the general direction of the energy industry and NLC India’s historical actions. For the latest and most accurate information about NLC India’s future plans and developments, please refer to the company’s official communications and reports.

Conclusion

NLC India Ltd’s journey towards greening the grid exemplifies its dedication to shaping a sustainable and prosperous future for India. By embracing renewable energy sources and spearheading innovative technologies, the company is not only contributing to India’s clean energy targets but also setting a precedent for other industries to follow. As India strides toward a cleaner, greener future, NLC India Ltd stands as a beacon of hope and inspiration in the nation’s clean energy revolution.

Fundamental Data study

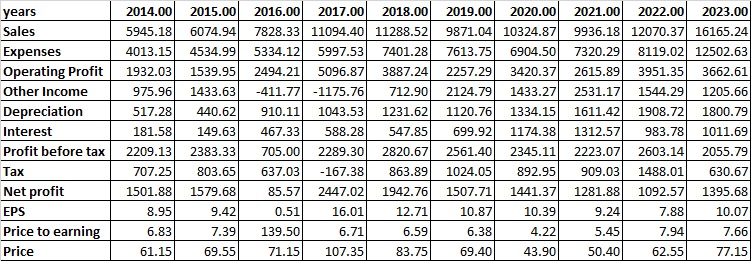

Certainly, let’s analyze the data for the years 2014 to 2023 for NLC India Ltd:

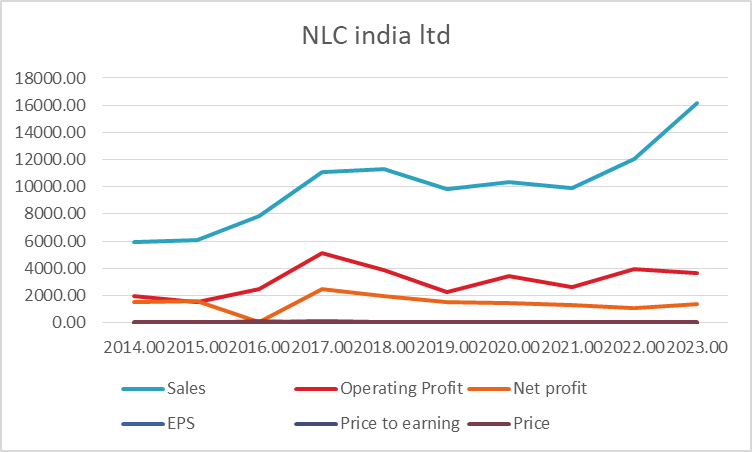

- Sales: NLC India’s sales have shown a consistent upward trend over the years, with a significant increase from 5945.18 in 2014 to 16165.24 in 2023. This reflects the company’s growth and expanding business operations.

- Expenses: While expenses have generally increased, there seems to be a more pronounced increase in recent years, particularly from 2019 to 2023. This could be due to various factors, including operational expansion, inflation, and other cost drivers.

- Operating Profit: The operating profit has shown fluctuations, with notable growth in 2017 and 2022. However, there is a decline in operating profit in the last two years (2022 and 2023) compared to the previous years.

- Other Income: Other income has varied over the years, with a significant positive spike in 2019 and 2021. This could be attributed to non-operating or exceptional income sources.

- Depreciation: Depreciation expenses have been on the rise, indicating an increase in the use of tangible assets over the years.

- Interest: Interest expenses have fluctuated but have remained relatively stable over the years, with a peak in 2020 and 2021.

- Profit before Tax: The profit before tax has shown a pattern of growth until 2017, a dip in 2018, followed by an upward trend again until 2022. There’s a notable decline in 2023 compared to the previous year.

- Tax: Tax expenses have varied, including negative values in 2017. There’s a significant increase in tax expenses in 2019 and 2022.

- Net Profit: Net profit has also shown fluctuations, with a peak in 2017, a dip in 2018, and subsequent recovery in the following years.

- Earnings Per Share (EPS): EPS has experienced fluctuations, with a substantial increase in 2017 and 2022. It dropped in 2018 and has been relatively stable in recent years.

- Price-to-Earnings (P/E) Ratio: The P/E ratio, which indicates the market’s valuation of the company’s earnings, has shown variability. It was high in 2016 and 2018, but generally, it’s within a moderate range over the years.

- Stock Price: The stock price has generally followed an upward trend, with fluctuations. Notably, there’s a significant increase in 2023 compared to the previous year.

Conclusion: NLC India’s financial data reveals a company that has experienced growth in sales and profitability over the years, with some periods of volatility. The expansion of sales indicates a growing business, although expenses have also increased, impacting operating profit. The company’s net profit has shown fluctuations, and there have been variations in tax and other financial metrics. The stock price has generally followed an upward trend, with notable fluctuations.

It’s important to note that financial trends can be influenced by various external and internal factors, including economic conditions, industry trends, government policies, and company-specific strategies. It’s advisable to conduct a more comprehensive analysis, including a review of recent news and updates, to gain a clearer understanding of the company’s current position and future prospects.

Our Final Take

Based on a technical analysis of the stock chart, it appears that the stock is currently undergoing a breakout and poised for further upward movement. This technical signal, when coupled with strong fundamental data indicating a robust developmental trend in the near future, suggests the potential for a substantial increase in the stock price over the coming years. As a result, investing in this stock at its current valuation could present an opportunity for significant gains, with potential target levels at 225, 280, and even 350.

It’s important to note that while the technical and fundamental indicators are promising, investing in the stock market carries inherent risks. Therefore, it’s advisable to conduct thorough research, consider various factors, and seek advice from financial professionals before making any investment decisions.

Please conduct your own due diligence and research before making any investment choices. The combination of technical and fundamental analysis can offer valuable insights, but it’s crucial to consider the broader market context and your individual financial goals.