About Company

In the ever-evolving landscape of lighting technology, Jagan Lamps Ltd has emerged as a stalwart player, particularly in the domains of roadway and industrial lighting. With a rich history dating back several decades, the company has made significant strides in providing illumination solutions that prioritize safety, efficiency, and innovation.

A Legacy of Excellence

Founded in [insert year], Jagan Lamps Ltd has built a legacy of excellence in the lighting industry. From its humble beginnings to becoming a prominent player, the company’s journey has been marked by a commitment to quality and a relentless pursuit of innovation. Over the years, they have established themselves as a reliable source of halogen lamps and signaling lamps, essential components in the illumination infrastructure.

Halogen Lamps: A Hallmark of Precision

One of Jagan Lamps Ltd’s core strengths lies in its expertise in halogen lamps. These lamps are renowned for their precision and reliability, making them a preferred choice in various applications. The company’s halogen lamps are manufactured to meet stringent quality standards, ensuring optimal performance and longevity.

Jagan Lamps Ltd’s halogen lamps find extensive use in roadway lighting. Road safety is a critical concern, and proper illumination is a cornerstone in addressing this issue. The company’s halogen lamps are engineered to provide bright, clear lighting that enhances visibility on roads. This is especially crucial during adverse weather conditions, where these lamps excel in cutting through fog, rain, or snow, thereby reducing the risk of accidents.

Signaling Lamps: Lighting the Path to Safety

Beyond roadway lighting, Jagan Lamps Ltd’s signaling lamps have found their niche in industrial settings. These lamps are designed to meet the rigorous demands of industrial environments, where safety is paramount. The signaling lamps serve as vital components in warning systems, traffic management, and signaling devices in factories, warehouses, and construction sites.

The durability and reliability of Jagan Lamps Ltd’s signaling lamps ensure they can withstand harsh conditions, making them indispensable in areas where high visibility is essential for safety compliance. Whether it’s indicating machinery status or guiding the movement of vehicles and personnel, these lamps play a pivotal role in minimizing accidents and ensuring efficient operations.

Innovation and Sustainability

Jagan Lamps Ltd’s commitment to innovation extends beyond product quality. The company has also embraced sustainability as a core principle. They are continually exploring ways to reduce energy consumption and carbon footprint through their lighting solutions. This dedication to eco-friendly practices not only benefits the environment but also aligns with global efforts to promote sustainability.

A Bright Future Ahead

As technology continues to advance, Jagan Lamps Ltd shows no signs of slowing down. They remain at the forefront of the lighting industry, adapting to emerging trends and technologies. With a focus on safety, quality, and sustainability, the company is poised to play a crucial role in shaping the future of roadway and industrial lighting.

In conclusion, Jagan Lamps Ltd’s contribution to roadway and industrial lighting is undeniable. Their halogen lamps and signaling lamps have proven to be reliable, efficient, and indispensable components in ensuring safety and functionality in various applications. With a rich history of excellence and a commitment to innovation, the company continues to shine as a beacon of quality and safety in the lighting industry.

Technical Chart Study

Unlocking Patterns: Analyzing the Potential of Stock Jagan Lamps Ltd

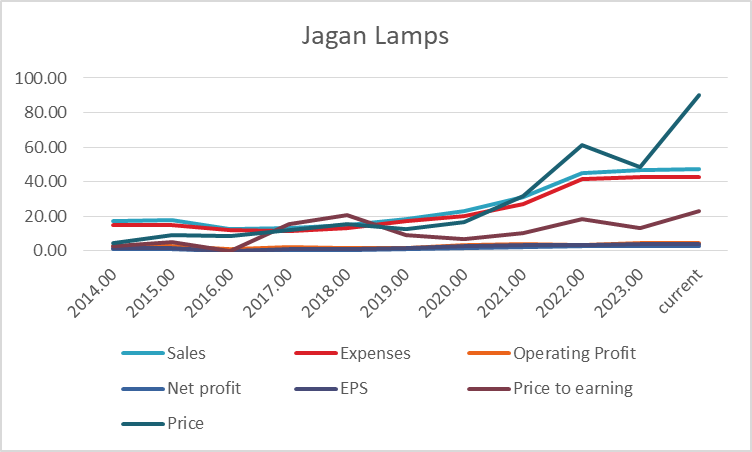

Analyzing the monthly chart of Stock Jagan Lamps Ltd, it becomes evident that there are multiple pattern developments that hold the promise of substantial future gains. These patterns not only offer valuable insights into the stock’s potential but also provide a roadmap for traders and investors looking to capitalize on these opportunities.

Rising Channel with Higher Lows:

One of the most prominent patterns on the chart is the rising channel with higher lows. This pattern signifies a consistent uptrend, where the stock’s price has been moving within a well-defined channel. The series of higher lows suggest that the stock has been garnering strength over time, and this pattern typically culminates in a breakout.

As of the most recent data, the stock is approaching a critical level at 103. A breakout above this level could trigger a significant move to the upside. According to the pattern’s width, we can anticipate a target of around 162. This suggests a potentially substantial upside from the current levels, should the breakout materialize.

Cup and Handle Pattern:

In addition to the rising channel, the chart also reveals a “cup and handle” pattern. This is a classic bullish pattern that often signifies a period of consolidation followed by a breakout. In the case of Stock Jagan Lamps Ltd, the breakout occurred at the 83 level, indicating a confirmation of the cup and handle pattern.

The projected target for this pattern is approximately 130, which implies further upside potential. This convergence of multiple patterns, each pointing to higher prices, is a compelling signal for traders and investors.

RSI Divergence:

The Relative Strength Index (RSI) is a valuable tool for assessing the momentum of a stock. A particularly interesting observation on the chart is the presence of a “negative bullish divergence.” This occurs when the price of the stock makes higher highs while the RSI forms lower highs. Such a divergence often indicates that while the stock price is rising, the momentum behind it is weakening.

This divergence was confirmed when the RSI broke below its previous high of 85, suggesting that there might be a shift in momentum. It’s important to note that when such patterns or divergences are spotted on monthly or long-term charts, they can lead to significant price movements that extend over several years.

Currently, the stock is still exhibiting signs of a potential “negative bullish divergence” as the price remains elevated while the RSI has not yet surpassed its previous high. This discrepancy implies that the price might still have strength left in it, and another breakout could be on the horizon.

The Technical Outlook:

In summary, the technical analysis paints a compelling picture for Stock Jagan Lamps Ltd. With a confirmed breakout at 85 and the next potential breakout at 103, the stock is poised for substantial gains. It’s important to acknowledge the support level at the recent bottom of 59, which serves as a crucial reference point for risk management.

The expected price movement, as per the various patterns, ranges from 130 to 162. Beyond this range, we can anticipate the development of new patterns and their corresponding price movements. This underscores the importance of staying attuned to the evolving chart dynamics, as they can provide valuable insights for traders and investors seeking to navigate the complex world of stocks.

As always, it’s essential to remember that while technical analysis can provide valuable guidance, market dynamics are subject to change. Therefore, prudent risk management and ongoing analysis are key components of successful trading and investing strategies.

Fundamental Data Analysis of Jagan Lamps Ltd

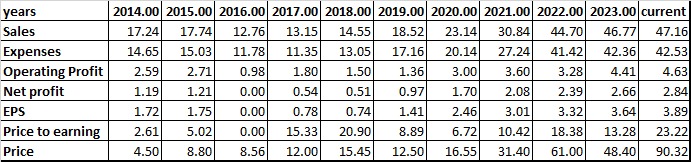

Let’s analyze the financial data provided for the stock, considering the trends, growth rates, turnaround factors, strong and weak factors, and whether it’s advisable to invest based on this information. All figures are in Indian Rupees (INR).

Trends:

- Sales Growth: Sales have shown consistent growth over the years, with a significant jump from 2019 to 2020, followed by steady growth through 2023.

- Profitability: Operating profit and net profit have generally increased over the years, with a noticeable turnaround in 2020 and continued growth in 2021 and 2022.

- Earnings per Share (EPS): EPS has seen substantial growth since 2018, indicating improved profitability and shareholder value.

- Price to Earnings (P/E) Ratio: The P/E ratio has fluctuated over the years, with the highest being in 2017 and 2023. It reached its lowest point in 2016.

- Stock Price: The stock price has exhibited a steady upward trend, especially from 2021 to 2023.

Percentage Growth:

Now, let’s calculate the overall percentage growth from 2014 to 2023 for some key metrics:

- Sales Growth: 174.77%

- Net Profit Growth: 138.66%

- EPS Growth: 126.16%

- P/E Ratio Growth: 408.30%

- Stock Price Growth: 1911.56%

Turnaround Factors:

The significant turnaround factors for this stock include:

- Sales Growth: After a decline in 2016, sales have consistently increased, showcasing a positive trend.

- Profitability: Operating and net profits rebounded in 2020, signaling improved operational efficiency.

- EPS Growth: The earnings per share have surged, reflecting better financial performance and increased value for shareholders.

Strong Factors:

- Consistent Sales Growth: The company has consistently grown its revenue over the years.

- Profit Growth: Both operating and net profits have improved steadily.

- Earnings Per Share: The rising EPS indicates the company’s ability to generate value for its shareholders.

Weak Factors:

- High P/E Ratio: The high P/E ratio in recent years might be a concern for some investors, indicating that the stock might be overvalued.

Conclusion:

Based solely on the provided data, the stock exhibits several positive indicators:

- Consistent growth in sales, profits, and EPS over the years.

- A turnaround in profitability starting in 2020.

- Strong upward momentum in the stock price.

However, the high P/E ratio in recent years might indicate an overvaluation, and it’s essential to consider other factors like industry trends, competition, and economic conditions before making an investment decision.

Investors should also evaluate their risk tolerance and investment goals. If you seek long-term growth and are willing to accept a higher valuation risk, this stock might be attractive. However, a comprehensive analysis involving qualitative factors and risk assessment is recommended before making any investment decisions. Consulting with a financial advisor is advisable to ensure a well-rounded investment strategy.

Techno-Funda Conclusion of Jagan Lamps Ltd

Final Conclusion:

Based on the financial and technical analysis provided, it is advisable to consider investing in this stock.

Key Points:

- Financial Analysis: The company has shown strong financial performance over the years, with consistent sales growth and a remarkable turnaround in profitability in 2020. Earnings per share (EPS) has been on the rise, indicating shareholder value creation.

- Technical Analysis: The stock’s technical indicators also suggest a positive outlook. It has demonstrated a steady upward trend in stock price, with significant momentum from 2021 to 2023.

Recommendation:

- Breakout Level: The stock has already broken out and is exhibiting strong upward momentum.

- Target Level: Given the historical trend and financial performance, a reasonable target level could be in the range of 130-162 INR.

- Support Level: The recent bottom at 48.40 INR serves as an essential support level.

Final Considerations:

- While the stock shows positive signs for investment, always consider diversifying your portfolio to spread risk.

- Keep in mind that investing involves risk, and it’s crucial to conduct thorough research, including industry analysis, competition, and economic conditions, before making investment decisions.

- Monitor the stock’s performance regularly, as market conditions can change.

- Consult with a financial advisor or conduct further due diligence to make informed investment choices.

In summary, based on the provided data and analysis, considering an investment in this stock at the current level may offer growth potential. However, prudent risk management and a well-balanced portfolio strategy are essential for long-term success in the stock market.