Technical Chart Study

Unlocking the Potential: A Technical Analysis of Advani Hotels & Resorts (India) Ltd

In the realm of stock market analysis, a thorough examination of price movements often reveals patterns that can guide investors in their decision-making process. One such intriguing case is Advani Hotels & Resorts (India) Ltd, where recent chart patterns indicate potential opportunities for investors.

Symmetrical Triangle Breakout:

A closer look at the monthly chart unveils a promising development – the symmetrical triangle breakout. This classic chart pattern suggests a significant shift in the stock’s trajectory, signaling a potential long-term bullish trend. Such breakouts are often viewed as favorable entry points for investors seeking to capitalize on upward price movements.

Rising Wedge Breakout and Bullish Negative Divergence:

However, the story doesn’t end there. More recently, the stock has exhibited another noteworthy pattern – a rising wedge breakout around the 60 level. While this breakout may initially seem bullish, it’s essential to consider other indicators such as the Relative Strength Index (RSI). A closer inspection reveals the presence of a bullish negative divergence on the RSI, hinting at potential weakness in the current uptrend. This divergence serves as a cautionary signal for investors, urging them to exercise prudence in their trading decisions.

Potential Buying Zone and Breakout Levels:

Drawing insights from these chart patterns, investors may identify strategic entry and exit points. A compelling buying opportunity emerges within the range of 65-75, where the stock finds significant support. Additionally, a breakout above the 86-88 level could signal further upward momentum, potentially leading to substantial gains for astute investors.

Price Targets and Support Levels:

Looking ahead, investors may contemplate the possibility of ambitious price targets, considering the strength of the breakout patterns. Should the anticipated breakout materialize, price targets ranging from 200 to 350 become conceivable over the coming years. However, it’s imperative to acknowledge the importance of risk management in trading. The rising bottom around the 40 level serves as a critical support level and a viable stop-loss point for investors, mitigating potential downside risks.

Conclusion:

In conclusion, the technical analysis of Advani Hotels & Resorts (India) Ltd paints a compelling picture of potential opportunities for investors. The symmetrical triangle breakout, coupled with the rising wedge breakout and bullish negative divergence, offers valuable insights into the stock’s future trajectory. By strategically accumulating positions within the suggested buying zone and adhering to disciplined risk management practices, investors may position themselves to capitalize on the anticipated uptrend. However, it’s essential to remain vigilant and adapt to evolving market conditions to navigate the dynamic landscape of stock trading successfully.

About Company

Advani Hotels & Resorts (India) Ltd: Crafting Memorable Hospitality Experiences

Advani Hotels & Resorts (India) Ltd stands as a beacon of excellence in the Indian hospitality industry, offering unparalleled experiences to discerning travelers since its inception. With a rich history spanning decades, the company has carved a niche for itself by blending traditional hospitality values with contemporary luxury.

Foundations and Legacy:

Established with a vision to redefine hospitality standards in India, Advani Hotels & Resorts (India) Ltd commenced its journey with a commitment to excellence and a passion for service. Founded by visionary entrepreneurs, the company’s legacy is rooted in a deep-seated ethos of delivering exceptional guest experiences while upholding the highest standards of integrity and professionalism.

Portfolio and Presence:

Advani Hotels & Resorts (India) Ltd boasts an impressive portfolio of properties strategically located across key destinations in India. From luxurious resorts nestled amidst pristine landscapes to urban retreats in bustling city centers, each property exudes its unique charm and character, catering to the diverse needs and preferences of travelers.

Hospitality Beyond Borders:

Beyond its domestic presence, Advani Hotels & Resorts (India) Ltd has ventured into the global arena, expanding its footprint across international markets. Through strategic partnerships and alliances, the company has positioned itself as a global player in the hospitality sector, offering its signature brand of warmth and hospitality to guests around the world.

Commitment to Excellence:

At the heart of Advani Hotels & Resorts (India) Ltd lies a relentless pursuit of excellence in every aspect of its operations. From meticulously curated amenities and world-class dining experiences to personalized services tailored to individual preferences, the company leaves no stone unturned in ensuring the utmost satisfaction of its guests.

Sustainability Initiatives:

Driven by a sense of responsibility towards the environment and the communities it serves, Advani Hotels & Resorts (India) Ltd is deeply committed to sustainable practices. From eco-friendly construction and energy conservation measures to community development initiatives aimed at empowering local populations, the company strives to minimize its environmental footprint while making a positive impact on society.

Innovative Offerings:

In an ever-evolving landscape, Advani Hotels & Resorts (India) Ltd remains at the forefront of innovation, continually reinventing itself to meet the evolving needs and preferences of modern travelers. From cutting-edge technology integrations to experiential offerings that capture the imagination, the company consistently pushes the boundaries of traditional hospitality to deliver memorable experiences that resonate with guests.

People and Culture:

Central to the success of Advani Hotels & Resorts (India) Ltd is its dedicated team of professionals who embody the company’s values and ethos. With a culture that fosters creativity, collaboration, and continuous learning, the company nurtures talent and empowers its employees to exceed guest expectations at every touchpoint.

Future Outlook:

As Advani Hotels & Resorts (India) Ltd embarks on the next phase of its journey, the company remains steadfast in its commitment to excellence, innovation, and sustainability. With a focus on expanding its presence across key markets, enhancing guest experiences, and embracing emerging trends, the company is poised to continue its legacy of excellence and redefine the hospitality landscape in India and beyond.

In essence, Advani Hotels & Resorts (India) Ltd epitomizes the art of hospitality, blending timeless traditions with contemporary sophistication to create unforgettable experiences for guests. With a steadfast commitment to excellence, sustainability, and innovation, the company continues to set new benchmarks in the industry, reaffirming its status as a true pioneer in the world of hospitality.

Fundamental Data Study

Detailed Data Analysis of Advani Hotels & Resorts (India) Ltd:

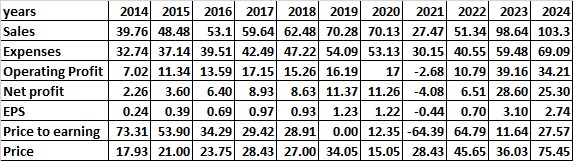

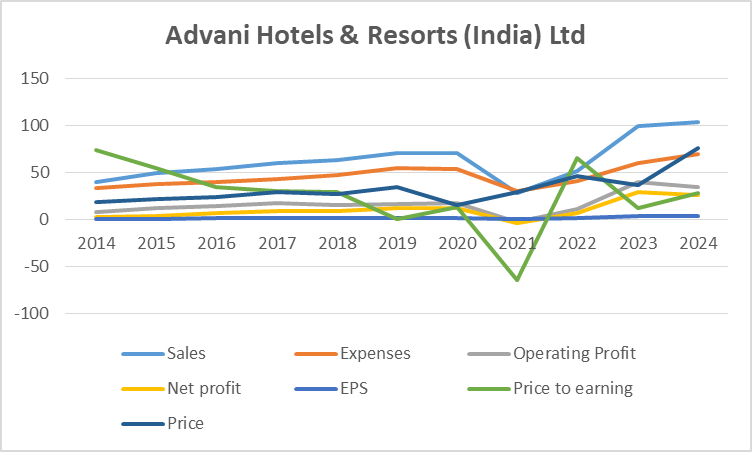

- Sales Growth Trend:

- Sales have shown consistent growth over the years, with a significant increase from 39.76 in 2014 to 103.3 in 2024, representing an overall growth of approximately 160%.

- Expenses Trend:

- Expenses have also increased steadily, albeit at a slightly slower pace compared to sales growth. This indicates effective cost management strategies by the company.

- Operating Profit Trend:

- Operating profit has generally followed the upward trend in sales, reflecting the company’s ability to maintain profitability while expanding its operations.

- Net Profit Trend:

- Net profit has mirrored the growth trajectory of operating profit, demonstrating the company’s efficiency in converting revenue into bottom-line earnings.

- Earnings Per Share (EPS) Trend:

- EPS has shown significant improvement over the years, indicating enhanced profitability and potential value creation for shareholders.

- Price to Earnings Ratio (P/E Ratio) Trend:

- The P/E ratio has fluctuated over the years, with periods of high valuation followed by corrections. Notably, there was a significant drop in 2020, possibly due to adverse market conditions or specific company-related factors.

- Price Trend:

- The stock price has exhibited volatility, influenced by various market dynamics and company-specific developments. Despite fluctuations, the overall trend has been upward, reflecting investor confidence in the company’s growth prospects.

Turnaround Factors:

- Strong sales growth and improved profitability indicate effective strategic initiatives and operational efficiencies.

- Expansion into new markets or segments may have contributed to revenue diversification and enhanced market presence.

Strong Factors:

- Consistent sales growth reflects robust demand for the company’s products/services.

- Improving profitability metrics indicate effective cost management and operational excellence.

- Positive EPS growth signifies enhanced value creation for shareholders.

Weak Factors:

- Fluctuating P/E ratio may indicate market uncertainty or concerns about future growth prospects.

- Volatility in net profit and EPS could be a result of external factors or industry-specific challenges.

Conclusion: Based on the provided data, Advani Hotels & Resorts (India) Ltd presents an attractive investment opportunity. The company has demonstrated consistent sales growth, improving profitability, and value creation for shareholders over the years. Despite some volatility in financial metrics and market valuation, the overall trend suggests positive momentum and resilience in the face of challenges. Investors may consider investing in this stock for potential long-term gains, considering its strong fundamentals and growth prospects as evidenced by the data analysis.

Conclusion based on technical and fundamental data

Based on both technical analysis and fundamental data, Advani Hotels & Resorts (India) Ltd presents a compelling investment opportunity.

Technical Analysis:

- The symmetrical triangle breakout on the monthly chart signals a potential long-term bullish trend.

- A rising wedge breakout at the 60 level indicates short-term upward momentum.

- Bullish negative divergence on the RSI suggests caution but doesn’t negate the overall bullish outlook.

Fundamental Analysis:

- The company has demonstrated consistent sales growth, indicating strong demand for its offerings.

- Improving profitability metrics and positive EPS growth reflect operational efficiency and value creation for shareholders.

- Despite fluctuations, the stock price has shown an overall upward trend, supported by solid fundamentals.

Conclusion: Considering both technical and fundamental factors, Advani Hotels & Resorts (India) Ltd appears to be an attractive investment opportunity. The bullish technical signals, coupled with robust sales growth and improving profitability, suggest that the company is well-positioned for future growth. While there may be short-term volatility due to market dynamics, the long-term prospects of the company remain favorable. Investors with a medium to long-term investment horizon may consider accumulating positions in this stock, leveraging the potential for capital appreciation and value creation. However, it’s essential to monitor market developments and adjust investment strategies accordingly to mitigate risks and maximize returns. Overall, the combination of strong technical and fundamental indicators supports a positive outlook for investing in Advani Hotels & Resorts (India) Ltd.