Technical chart study

Based on the technical chart pattern analysis, Cochin Minerals & Rutile Ltd. exhibits a promising upward trajectory, suggesting a potentially lucrative investment opportunity. Upon examining the monthly chart, it’s evident that the stock has been on a robust uptrend. Notably, it recently formed a symmetrical triangle pattern, which it successfully breached to achieve its target. Currently, the stock appears to be forming a rising channel along with a smaller symmetrical triangle pattern.

Historically, when a stock breaks out of significant chart patterns, such as symmetrical triangles, on a lifetime chart, it tends to experience strong momentum for the subsequent 2-3 years. Considering this pattern, the current price level of 280 presents an attractive buying opportunity. The upside potential indicates a target of 450, with the possibility of further escalation to 900, 1500, and even 3000 levels over the next 2-5 years.

From a technical standpoint, the formation of a rising channel coupled with another symmetrical triangle pattern reinforces the bullish sentiment. Such patterns often signify a continuation of the prevailing uptrend, suggesting that Cochin Minerals & Rutile Ltd. could experience sustained growth in the foreseeable future.

To mitigate risk and ensure prudent investment management, it’s essential to establish a strong support level or stop-loss point. In this case, setting the stop-loss at 170 provides a reasonable buffer against adverse price movements while aligning with the overall bullish outlook.

Investors should also consider other fundamental factors alongside technical analysis to make well-informed decisions. Factors such as market sentiment, industry trends, and company fundamentals can provide additional insights into the stock’s potential performance.

In summary, Cochin Minerals & Rutile Ltd. presents a compelling opportunity for investors based on its strong technical indicators. With the stock exhibiting bullish patterns and a clear upward trajectory, purchasing at the current price level of 280 could yield significant returns over the coming years. However, it’s imperative for investors to conduct thorough research and exercise diligence before making any investment decisions.

About Company

Cochin Minerals & Rutile Ltd. is a pioneering entity in the mineral industry, renowned for its innovative approach to mineral extraction and processing. Established several decades ago, the company has evolved into a key player in the global market, leveraging its expertise and advanced technologies to extract and refine minerals with utmost efficiency and precision.

At the heart of Cochin Minerals & Rutile Ltd.’s operations lies its commitment to sustainable practices and environmental responsibility. The company places a strong emphasis on minimizing its ecological footprint and ensuring that its operations have minimal adverse impact on the surrounding environment. Through the implementation of cutting-edge technologies and adherence to stringent environmental regulations, Cochin Minerals & Rutile Ltd. has established itself as a responsible steward of natural resources.

One of the primary strengths of Cochin Minerals & Rutile Ltd. lies in its diverse portfolio of minerals. The company specializes in the extraction and processing of a wide range of minerals, including rutile, ilmenite, zircon, and garnet, among others. These minerals find applications across various industries, including aerospace, automotive, construction, and electronics, making them integral components of modern manufacturing processes.

Furthermore, Cochin Minerals & Rutile Ltd. distinguishes itself through its relentless pursuit of innovation and technological advancement. The company continuously invests in research and development initiatives to enhance its extraction and processing techniques, optimize resource utilization, and improve product quality. By staying at the forefront of technological innovation, Cochin Minerals & Rutile Ltd. remains well-positioned to meet the evolving demands of its customers and maintain its competitive edge in the market.

In addition to its focus on technological innovation, Cochin Minerals & Rutile Ltd. prioritizes strategic partnerships and collaborations to expand its market reach and enhance its value proposition. The company actively engages with industry stakeholders, including suppliers, distributors, and customers, to foster mutually beneficial relationships and drive mutual growth and success.

From a financial perspective, Cochin Minerals & Rutile Ltd. has demonstrated commendable performance, consistently delivering strong financial results and generating value for its shareholders. With a robust revenue stream and healthy profit margins, the company has maintained its financial stability and resilience even in the face of economic uncertainties and market fluctuations.

Looking ahead, Cochin Minerals & Rutile Ltd. is poised for continued growth and success, fueled by its unwavering commitment to excellence, sustainability, and innovation. As the global demand for high-quality minerals continues to rise, the company is well-positioned to capitalize on emerging opportunities and solidify its position as a leader in the mineral industry. Through its steadfast dedication to delivering superior products and services, Cochin Minerals & Rutile Ltd. is poised to shape the future of the mineral industry and contribute to sustainable development on a global scale.

Fundamental Analysis

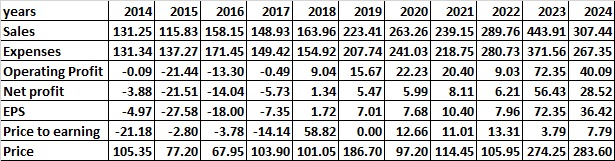

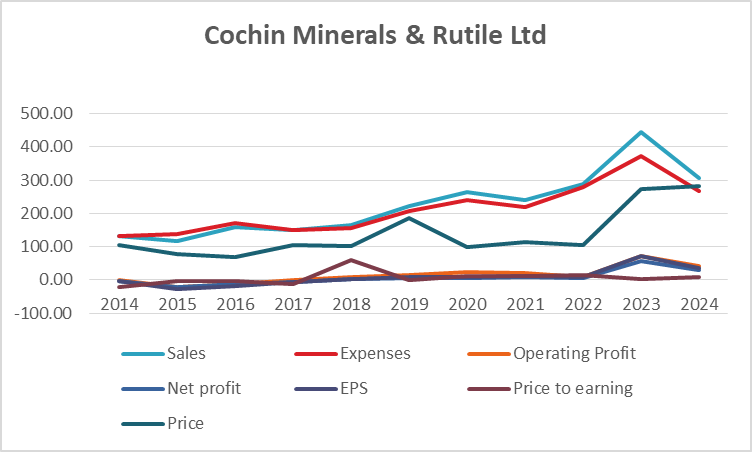

Here’s a detailed analysis of the financial data provided for Cochin Minerals & Rutile Ltd.:

- Sales Trend:

- The sales trend shows fluctuation over the years, with an overall growth pattern.

- There was a significant increase in sales from 2016 to 2023, indicating a positive growth trajectory.

- Expenses Trend:

- Expenses have also increased over the years but at a slower pace compared to sales.

- However, there was a slight decrease in expenses from 2022 to 2023, which could be a positive sign for profitability.

- Operating Profit Trend:

- Operating profit has been volatile, with both positive and negative figures.

- There’s a notable improvement in operating profit from 2019 onwards, suggesting operational efficiencies.

- Net Profit Trend:

- Net profit follows a similar pattern to operating profit, indicating that fluctuations in expenses have a direct impact on profitability.

- There was a significant increase in net profit from 2022 to 2023, indicating improved profitability.

- Earnings Per Share (EPS) Trend:

- EPS follows the trend of net profit, reflecting changes in profitability per share.

- There was a substantial increase in EPS from 2022 to 2023, indicating enhanced earnings potential for shareholders.

- Price to Earning (P/E) Ratio Trend:

- P/E ratio shows significant fluctuations over the years, indicating market sentiment and investor confidence.

- The P/E ratio became negative in 2020, which could be due to various factors impacting investor perception.

Turnaround Factors:

- Improved operational efficiency leading to increased profitability from 2019 onwards.

- Significant increase in net profit and EPS from 2022 to 2023, suggesting a turnaround in financial performance.

Strong Factors:

- Consistent growth in sales over the years.

- Improvement in profitability indicators from 2019 onwards.

- Substantial increase in net profit and EPS from 2022 to 2023.

Weak Factors:

- Volatility in operating profit and net profit in earlier years.

- Fluctuations in expenses impacting profitability.

Based on the provided financial data, Cochin Minerals & Rutile Ltd. demonstrates a positive growth trajectory, with improving profitability in recent years. The significant increase in net profit and EPS from 2022 to 2023 suggests a potential turnaround in financial performance. Despite fluctuations in operating profit and expenses, the overall trend indicates positive momentum. Considering the strong factors such as consistent sales growth and improved profitability, along with the recent turnaround factors, investing in this stock could be considered a viable option. However, investors should conduct further research and analysis to assess other factors such as market conditions and industry outlook before making investment decisions.

Technical and fundamental view combined

Based on the combined analysis of both technical indicators and fundamental data, here is the final conclusion regarding investing in Cochin Minerals & Rutile Ltd.:

Technical Analysis:

- The stock exhibits a strong upward trend on the monthly chart, supported by the formation of significant chart patterns such as symmetrical triangles and rising channels.

- Historical data suggests that when the stock breaks out of such patterns on a lifetime chart, it tends to experience strong momentum for the subsequent 2-3 years.

- The current price level of 280 presents a favorable buying opportunity, with potential upside targets of 450, 900, 1500, and even 3000 levels over the next 2-5 years.

- Setting a stop-loss at 170 provides a reasonable buffer against adverse price movements while aligning with the overall bullish outlook.

Fundamental Analysis:

- Cochin Minerals & Rutile Ltd. demonstrates a positive growth trajectory in terms of sales, with consistent increases over the years.

- While expenses have also increased, the company has managed to improve operational efficiency, leading to enhanced profitability from 2019 onwards.

- There was a significant increase in net profit and EPS from 2022 to 2023, indicating a potential turnaround in financial performance.

- Despite fluctuations in operating profit and expenses in earlier years, the overall trend suggests positive momentum in recent years.

Conclusion: Taking into account both technical and fundamental factors, Cochin Minerals & Rutile Ltd. appears to be a promising investment opportunity. The stock’s strong upward trend on the technical charts, coupled with improving financial performance and potential turnaround factors, suggests favorable prospects for investors. With the stock currently trading at 280 and the possibility of achieving significant upside targets in the coming years, investing in Cochin Minerals & Rutile Ltd. could yield attractive returns. However, as with any investment decision, it’s essential for investors to conduct thorough research, consider their risk tolerance, and monitor market conditions before making investment decisions.