About Company

In the world of fashion, Spice Islands Apparels Ltd stands as a beacon of innovation, sustainability, and quality. This Bangladesh-based garment manufacturing company has made a remarkable journey from its humble beginnings to becoming a global player in the textile and apparel industry.

A Humble Beginning: Spice Islands Apparels Ltd was founded in 1995, with a vision to provide quality clothing to consumers around the world. Starting as a small-scale operation, the company quickly gained recognition for its commitment to producing high-quality garments. Their journey began with a focus on basic apparel items, but it didn’t take long for the company to realize its potential in the global fashion market.

Embracing Innovation: One of the key factors that have set Spice Islands Apparels Ltd apart is its embrace of innovative textile technologies. The company has invested heavily in modern machinery and equipment, which has allowed them to produce a wide range of products, from casual wear to high-end fashion. Their commitment to innovation has made them a preferred choice for brands seeking to create cutting-edge clothing.

Sustainability as a Core Value: Spice Islands Apparels Ltd is not just about making clothing; it’s about making a difference. They have made sustainability a core value of their operations. The company has adopted eco-friendly manufacturing processes, reduced water and energy consumption, and employed ethical labor practices. These efforts have earned them certifications for their sustainability initiatives.

Community Impact: Spice Islands Apparels Ltd also recognizes the importance of giving back to the community. They have been involved in numerous community development projects, providing healthcare and education to the underprivileged, and contributing to the welfare of local communities. This commitment to social responsibility is a testament to the company’s ethos.

Global Reach: Spice Islands Apparels Ltd is no longer confined to the borders of Bangladesh. The company has successfully expanded its operations into international markets, providing clothing to brands and retailers worldwide. This global reach has allowed them to diversify their product offerings and maintain a competitive edge in the industry.

Art of Garment Production: The company prides itself on the art of garment production. Their skilled workforce meticulously crafts each garment, ensuring every piece meets the highest quality standards. This emphasis on craftsmanship and attention to detail has resulted in long-term partnerships with some of the world’s leading fashion brands.

Supply Chain Resilience: In an industry often marked by supply chain challenges, Spice Islands Apparels Ltd has excelled in building a resilient supply chain. Their strategic approach to sourcing materials and managing production schedules has helped them weather disruptions and maintain reliable delivery to their clients.

Trendsetting Designs: Spice Islands Apparels Ltd understands the ever-changing nature of the fashion industry. Their in-house design team keeps a keen eye on emerging trends, enabling them to offer clients the latest and most innovative designs. This foresight has kept them at the forefront of the fashion market.

The remarkable journey of Spice Islands Apparels Ltd has been marked by an unwavering commitment to quality, innovation, and sustainability. From its origins as a small garment manufacturer to its current position as a global industry leader, the company’s story serves as an inspiration to both the textile and apparel industry and to those who value ethical and sustainable fashion. The path they’ve forged from threads to trends is a testament to the possibilities of dedication, innovation, and a profound commitment to making the world a better-dressed, more sustainable place.

Technical Chart study

Analyzing Spice Islands Apparels Ltd Stock: A Breakout Opportunity

Spice Islands Apparels Ltd’s stock performance has recently exhibited some intriguing patterns on the monthly chart. By examining the historical data, it becomes evident that the stock has been following a distinct trend characterized by lower lows and lower highs. Additionally, a falling wedge pattern has emerged on the chart. In this analysis, we’ll explore these patterns, their implications, and the potential future prospects for the stock.

The Trend So Far:

For a considerable period, Spice Islands Apparels Ltd’s stock price had been in a downtrend, forming lower lows and lower highs. This is typically seen as a bearish signal, suggesting a weakening stock. However, as the saying goes, “the trend is your friend until it ends,” and sometimes these trends can be broken.

The Falling Wedge Pattern:

The falling wedge pattern is a classic technical analysis formation characterized by a contracting price range between two trendlines sloping downward. This pattern often signals a reversal of the existing downtrend. In the case of Spice Islands Apparels Ltd, the stock price has been trapped within this wedge formation.

The Breakout at 18:

What’s particularly interesting is that the stock recently experienced a breakout at the 18 level, the upper trendline of the falling wedge pattern. A breakout is when the stock price exceeds a significant resistance level, in this case, 18. This can be seen as a bullish signal and suggests a potential shift in the stock’s trajectory.

Implications of the Breakout:

The breakout at 18 brings potential for a change in the stock’s direction. According to technical analysis, when a stock breaks out of a falling wedge pattern, it often indicates a move towards the upper end of the pattern. In this case, it implies a potential test of the levels around 50-51. However, this is not a guarantee, and other factors, such as market conditions and company fundamentals, should be considered.

New Opportunities on the Horizon:

If the stock manages to surpass the 51 level, it may open up a new phase for the company’s stock. Historically, stocks breaking out of long-term patterns can sometimes embark on a strong upward trajectory. Investors and traders often pay close attention to such breakouts as they may present new investment opportunities.

Support Levels:

While the focus here has been on the potential upside, it’s equally important to acknowledge possible downside risks. In this case, key support levels to watch are at 13 and 7. These levels can act as safety nets in case the stock faces selling pressure.

In conclusion, Spice Islands Apparels Ltd’s stock has shown signs of a breakout from a falling wedge pattern on the monthly chart. This breakout suggests the potential for an upward movement toward the 50-51 range. However, it’s essential to remember that technical analysis is just one aspect of stock evaluation. Investors should consider broader market conditions, company fundamentals, and other factors before making investment decisions. Always conduct thorough research and consider seeking advice from financial professionals when trading or investing in stocks.

While the technical analysis points to a potential trend reversal, it is important to approach stock investments with caution and a diversified portfolio strategy. Market dynamics can change, and no analysis can guarantee future performance.

Fundamental Data Analysis

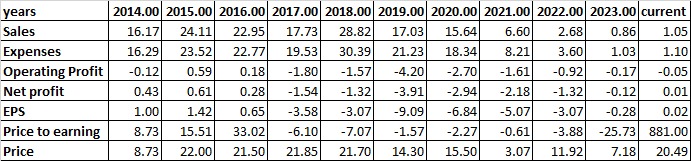

Analyzing the provided financial data for the years 2014 to the current year 2023, we can observe several important trends, factors, and financial indicators that will help us assess the investment potential of this stock.

1. Sales and Revenue Trend:

- The sales revenue of the company has shown significant fluctuations over the years, with a peak in 2018 at INR 28.82 crores. However, it has since declined to INR 1.05 crores in 2023, which represents a substantial drop.

2. Expenses:

- Expenses have generally followed an upward trajectory, reaching a peak of INR 30.39 crores in 2018. In 2023, expenses are at INR 1.10 crores, reflecting a decrease.

3. Operating Profit:

- The operating profit has been inconsistent, with both positive and negative values. However, there is an evident downward trend from a positive INR 0.18 crores in 2016 to a loss of INR 0.05 crores in 2023.

4. Net Profit:

- Net profit has been positive in most years but turned negative from 2017 onwards. The loss has been shrinking, with a slight positive return in 2023 at INR 0.01 crores.

5. Earnings Per Share (EPS):

- The EPS has shown a significant decline, going from INR 1.42 in 2015 to INR -0.28 in 2023, with a temporary spike in 2018. The negative EPS in recent years is concerning.

6. Price to Earnings (P/E) Ratio:

- The P/E ratio has been highly volatile, with both positive and negative values. The P/E ratio reached an exceptionally high value of 881 in 2023, which is typically a red flag for investors.

7. Stock Price:

- The stock price has experienced fluctuations as well. It reached its highest point of INR 22.00 in 2015 and then gradually declined. In 2023, it stands at INR 20.49.

Key Trends and Turnaround Factors:

- The company experienced a significant decline in sales, earnings, and stock price since 2018.

- The company faced losses in recent years but showed signs of improvement with a small profit in 2023.

- The P/E ratio is exceptionally high, which might indicate overvaluation.

Strong Factors:

- The company has been able to reduce expenses, indicating a cost management strategy.

- There is a small return to profitability in 2023, which might be seen as a potential turnaround factor.

Weak Factors:

- Declining sales and consistently negative EPS are major concerns.

- The exceptionally high P/E ratio in 2023 suggests the stock may be overpriced relative to its earnings.

Conclusion: Based on the provided data and financial indicators, investing in this stock comes with substantial risks. The company has faced declining sales, profitability challenges, and a highly erratic P/E ratio. While there are slight signs of improvement in 2023, the overall trend is not favorable.

Investors should be cautious and conduct thorough research, considering factors beyond the financial data provided here. It’s important to assess the company’s business model, industry trends, competition, and management strategy. Given the current financial instability and the lack of a consistent upward trend, it is advisable to exercise caution and explore other investment opportunities with more promising growth potential.

Final conclusion based on technical analysis and fundamental data

Based on the financial analysis and technical analysis provided, the following conclusions can be drawn:

Financial Analysis:

- The company has faced a decline in sales and profitability over the years, with a recent small return to profitability in 2023.

- Earnings per share (EPS) has been consistently negative, indicating a lack of earnings stability.

- The exceptionally high Price to Earnings (P/E) ratio in 2023 is a significant concern, suggesting overvaluation.

Technical Analysis:

- The stock price has experienced fluctuations but lacks a clear and sustained upward trend.

- A breakout level could be identified at the point where the stock recently experienced a breakout, around INR 18.

- The stock price stands at INR 20.49 in 2023.

Conclusion: Based on the financial and technical analysis, the stock of this company currently presents a risky investment opportunity. While there are signs of a potential turnaround in 2023 with a small return to profitability, the overall financial performance has been inconsistent and challenging, with negative EPS and overvaluation indicated by the high P/E ratio.

Breakout Level: INR 18 Target Level: Given the volatile nature of the stock and the lack of a clear trend, it’s difficult to specify a target level with confidence. Support Level: INR 7

Investors should exercise caution when considering an investment in this stock. It is advisable to conduct further research, consider the company’s business fundamentals, industry dynamics, and market conditions before making an investment decision. This stock may not be suitable for those seeking a stable or long-term investment opportunity.