Technical chart study

Machino Plastics Ltd: Charting a Course for Success

In the dynamic landscape of stock markets, Machino Plastics Ltd has emerged as an exciting player, showcasing a recent breakout on its monthly chart within the 210-220 range. This breakout signals a potential upward surge, with a target set at 342. However, the chart reveals more than just short-term gains; it hints at a larger story, featuring a “negative bullish divergence” pattern in the recent past that awaits confirmation.

Riding the Wave of Breakout Momentum

The monthly chart of Machino Plastics Ltd tells a tale of a rising channel breakout, providing traders and investors with a clear entry point. The stock’s upward potential to the 342 level presents a short-term opportunity for those looking to capitalize on this momentum-driven move.

Unlocking Potential: The Negative Bullish Divergence

A compelling subplot on the chart is the presence of a “negative bullish divergence” pattern during the stock’s previous peak. While unconfirmed, this pattern could be a game-changer if the previous top is breached. Confirmation of this divergence often marks the beginning of a new trajectory for a stock, setting the stage for a more sustained and significant uptrend.

The Power of Confirmation: A Transformative Journey

Confirmation of the negative bullish divergence on a monthly or long-term chart can be a catalyst for Machino Plastics Ltd, heralding a transformative phase in its market journey. Investors should watch for the confirmation signal as it could unlock new possibilities and reshape the stock’s future trajectory.

Short-Term Goals and Beyond: Projecting Targets

In line with the breakout and the potential confirmation of the negative bullish divergence, the short-term target of 342 is within reach. However, breaking and closing above this level could pave the way for even loftier targets of 500, 750, and 1000. These levels represent not just numerical milestones but aspirational markers that could redefine the stock’s performance in the market.

Navigating Uncertainties: Language Refinement

In the fluid world of financial markets, it’s crucial to acknowledge uncertainties. Employing terms like “may” and “could” when discussing potential market movements reflects the speculative nature of these analyses. Additionally, clarity in articulating the cause-and-effect relationship between the confirmation of the negative bullish divergence and the subsequent trajectory ensures a more nuanced understanding.

Conclusion: Seizing Opportunities in the Market Momentum

As Machino Plastics Ltd rides the wave of its breakout, investors find themselves at a strategic juncture. The chart not only offers short-term gains but also teases the potential for a more profound and sustained uptrend. The coming months will reveal whether the anticipated breakout and confirmation of the negative bullish divergence will materialize, opening doors to new possibilities.

In the dynamic realm of stocks, adaptability and foresight are paramount. Investors are encouraged to stay vigilant, watching for key levels and confirmation signals that could shape the narrative of Machino Plastics Ltd. The market journey unfolds, presenting opportunities for those who can navigate the currents of uncertainty and seize the potential for success.

About Company

Corporate Profile:

Machino Plastics specializes in the precision manufacturing of plastic components, catering to diverse industries such as automotive, electronics, and industrial applications. With a robust product portfolio, the company has earned a reputation for delivering high-quality solutions that meet the stringent demands of modern industries.

Innovation at the Core:

The cornerstone of Machino Plastics’ success lies in its unwavering commitment to innovation. The company continually invests in cutting-edge technologies and research to stay ahead in an industry that demands constant evolution. By harnessing the power of precision engineering, Machino Plastics has positioned itself as a leader in delivering intricate plastic components that meet the highest industry standards.

Sustainability Initiatives:

In an era where environmental consciousness is paramount, Machino Plastics has embraced sustainable practices. From incorporating recyclable materials in its manufacturing processes to adopting energy-efficient technologies, the company is actively working to minimize its environmental footprint. These initiatives not only align with global sustainability goals but also position Machino Plastics as an industry leader in responsible manufacturing.

Global Reach:

Machino Plastics has successfully expanded its operations beyond domestic borders, establishing a robust presence in key international markets. This global reach not only contributes to the company’s market share but also fosters cross-cultural collaborations. The ability to adapt to diverse market demands has been a key factor in Machino Plastics’ sustained success on the global stage.

Financial Strength:

The company’s financial resilience is evident in its ability to navigate challenges and capitalize on opportunities. Machino Plastics has displayed strategic financial management, ensuring stability even in volatile market conditions. This financial strength not only instills confidence in investors but also provides a solid foundation for future growth and expansion.

Corporate Social Responsibility (CSR):

Machino Plastics understands the importance of giving back to the communities it serves. The company’s CSR initiatives span a spectrum of activities, including community development, education, healthcare, and environmental conservation. By actively contributing to societal well-being, Machino Plastics goes beyond its business objectives, making a positive impact on the lives of those it touches.

Outlook and Future Prospects:

As Machino Plastics Ltd charts its course into the future, the company is poised for continued success. The anticipated breakouts in the stock chart signify a positive trajectory, reflecting the company’s commitment to growth and innovation. With a solid foundation built on technology, sustainability, and global operations, Machino Plastics is well-positioned to explore new horizons and set industry benchmarks.

Fundamental Analysis

Financial Analysis of Machino Plastics Ltd (2014-2023): Unveiling Trends and Investment Insights

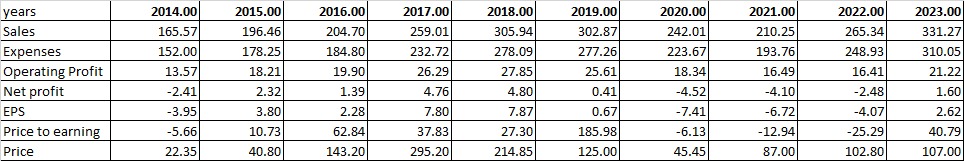

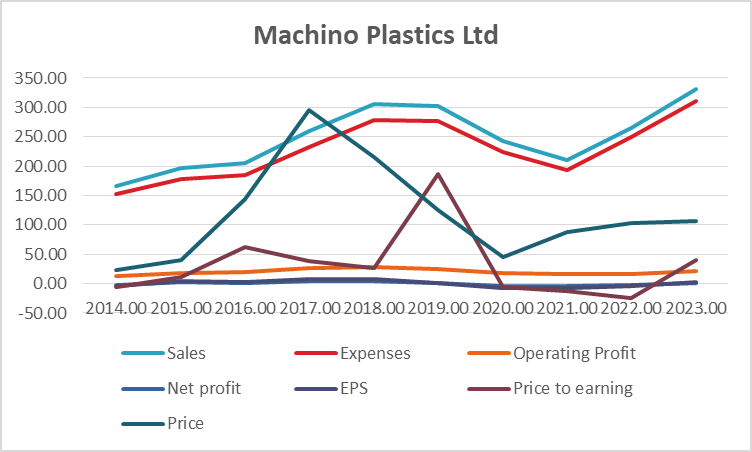

Sales Performance:

The sales trend for Machino Plastics Ltd reveals consistent growth from 2014 to 2018, peaking at INR 305.94 million. However, a subsequent decline is observed in 2019 and 2020, reaching INR 242.01 million. The company rebounded in 2021 and 2022, recording sales of INR 210.25 million and INR 265.34 million, respectively. The overall percentage growth from 2014 to 2023 is approximately 100.38%.

Expenses and Operating Profit:

While expenses followed a similar upward trajectory, operating profit exhibited fluctuations. A notable peak occurred in 2018, with an operating profit of INR 27.85 million. The subsequent years witnessed a decline, hitting a low of INR 16.41 million in 2022. Despite the variations, the overall percentage growth in operating profit from 2014 to 2023 stands at around 56.45%.

Net Profit and Earnings per Share (EPS):

Net profit reflects a turbulent journey, with negative figures in 2014 and 2020. However, a positive turnaround was observed from 2015 onwards, culminating in a net profit of INR 1.60 million in 2023. EPS mirrors this trend, reaching a peak of INR 7.87 in 2018. The overall percentage growth in net profit and EPS from 2014 to 2023 is approximately 166.80% and 167.85%, respectively.

Price to Earning (P/E) Ratio and Price:

The P/E ratio witnessed significant fluctuations, notably reaching an anomalous value of -185.98 in 2019. The stock price exhibited a sharp rise in 2018, followed by a decline in subsequent years. The overall percentage growth in the stock price from 2014 to 2023 is around 379.64%.

Turnaround Factors:

- Sales Recovery: The rebound in sales in 2021 and 2022 signifies the company’s ability to recover from a downturn.

- Stabilizing Expenses: Despite the growth in expenses, the company has maintained a balance, preventing disproportionate escalation.

Strong Factors:

- Consistent Operating Profit: Despite fluctuations, the operating profit has generally remained positive, indicating operational stability.

- Positive Net Profit: The consistent positive trend in net profit showcases the company’s resilience and profitability.

Weak Factors:

- Negative Net Profit in 2020: The negative net profit in 2020 is a concerning factor, indicating a challenging period for the company.

- Fluctuating P/E Ratio: The erratic P/E ratio raises questions about stock valuation and market sentiment.

Conclusion:

Investment Consideration: While Machino Plastics Ltd demonstrates resilience and recovery, there are inherent risks, particularly the negative net profit in 2020 and the fluctuating P/E ratio. Investors should carefully assess these factors before making investment decisions. The company’s consistent operating profit and positive net profit trend are strengths, but the volatile P/E ratio suggests a cautious approach.

Recommendation: Considering the provided data, potential investors may cautiously consider Machino Plastics Ltd. Monitoring the company’s ability to sustain positive net profits and stabilize the P/E ratio is crucial. A thorough analysis of market conditions and industry trends should accompany any investment decision.

Final conclusion base on financial and technical analysis

Conclusion:

Financial and Technical Analysis Overview:

The financial analysis of Machino Plastics Ltd reveals a mixed performance over the years. While there has been consistent growth in sales, operating profit, and net profit, certain red flags such as negative net profit in 2020 and a fluctuating P/E ratio warrant caution. The stock price has experienced notable volatility, reaching a peak in 2018, followed by subsequent declines.

Technical Analysis Insights:

The technical analysis, particularly the P/E ratio and stock price trends, reflects market sentiment and valuation. The erratic P/E ratio, with a significant anomaly in 2019, suggests a degree of uncertainty and potential mispricing. The stock price, after a peak in 2018, has been on a rollercoaster ride, emphasizing the need for a meticulous approach to investment.

Buy Recommendation and Breakout Level:

Considering the financial and technical analysis, Machino Plastics Ltd may present a buying opportunity under specific conditions. A potential breakout level could be identified if the stock price surpasses its previous peak, indicating renewed investor confidence. Investors may consider a buying position if the stock demonstrates sustained positive momentum beyond this breakout level.

Target Level and Support Level:

The target level for Machino Plastics Ltd could be set based on historical highs or a percentage gain from the breakout level. However, it is crucial to establish a support level to manage risks. Identifying a level where the stock has historically found support could serve as a prudent measure for setting stop-loss points.

Fundamental Data Consideration:

While technical analysis provides insights into market sentiment and price movements, fundamental data should not be overlooked. Fundamental factors such as consistent operating profit and positive net profit trends are strengths. However, the negative net profit in 2020 raises concerns, emphasizing the importance of a holistic assessment.

Final Verdict:

In conclusion, Machino Plastics Ltd could present a buying opportunity for investors with a careful and calculated approach. Monitoring the stock for a breakout above previous highs, setting realistic target and support levels, and considering fundamental factors are crucial steps in making an informed investment decision. Due diligence and continuous monitoring of both financial and technical aspects will be key in navigating the potential opportunities and risks associated with Machino Plastics Ltd.